The Evolving Landscape of Remote Work Taxes

Remote work has dramatically changed how we think about taxes, presenting both exciting new possibilities and complex new headaches. Where you choose to live, once a minor detail, now plays a major role in how much you owe in taxes. This shift has tax authorities scrambling to catch up, resulting in a constantly shifting and often confusing situation for remote workers.

Navigating the New Tax Terrain

The increase in remote work has blurred the traditional geographic lines when it comes to taxes. With employees potentially working from several different locations, questions about tax jurisdiction and compliance have become extremely important. This is particularly true in the US, where the complicated mix of state and local tax laws creates a difficult situation for both employees and employers.

For example, the concept of nexus has become increasingly critical. Nexus determines whether a company has a large enough presence in a state to be required to pay taxes there. If a remote employee works from a state different from their employer’s main location, that employee might unintentionally create a nexus for their company, leading to new tax responsibilities.

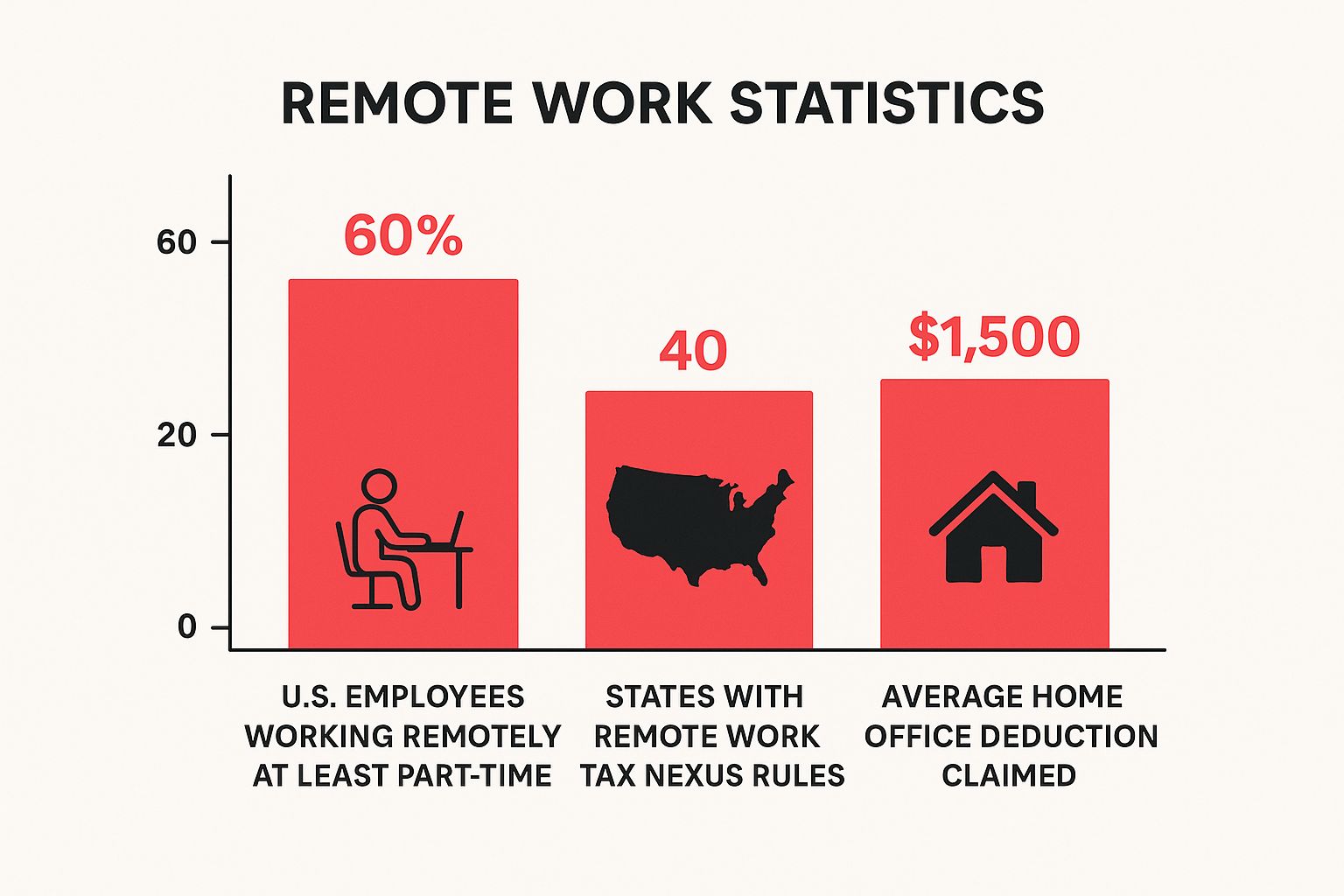

The infographic above shows some key statistics about remote work taxes in the US. It highlights that 60% of US employees work remotely at least part-time, 40 states have nexus rules specifically related to remote work, and the average home office deduction is $1,500. These numbers demonstrate how common remote work is and the increasing need for clear tax rules. This means a large part of the workforce might be affected by changing tax regulations, and many are claiming deductions for their home offices.

This changing situation is made even more complicated by the continued increase in remote workers. One key trend is the projected growth in the number of people working remotely. By 2025, it’s estimated that 32.6 million Americans will work remotely, showing the continuing rise of remote work arrangements. This shift has significant implications for tax policies, as employees might work from multiple locations, leading to uncertainty about which tax jurisdiction applies. More detailed statistics can be found here: Remote Work Statistics.

Staying Ahead of the Curve

Smart remote workers are actively looking for information and resources to help them understand this complex topic. They’re learning about the tax laws where they live, exploring possible deductions, and using tools like QuickBooks or Xero to track their work expenses. This proactive approach helps them avoid expensive mistakes and stay compliant with the latest regulations. By understanding the evolving rules around taxes, remote workers can enjoy the flexibility and freedom of remote work while minimizing what they owe.

Employer Tax Obligations in a Distributed World

The rise of remote work has significantly changed how employers and employees interact, especially when it comes to taxes. Businesses now must navigate the complex world of tax laws across multiple locations. This new distributed work model presents unique challenges for employers who want to stay compliant and reduce financial risks. Successfully managing remote teams requires a new set of leadership skills. For guidance on this topic, check out this resource on managing remote teams.

Determining Where to Withhold Taxes

One of the biggest challenges for employers is figuring out where to withhold taxes for remote employees. In the past, taxes were withheld based on the employer’s office location. However, with employees working from different states and countries, this old method no longer works. This shift to remote work is changing not only how we work but also how businesses handle their taxes. By 2025, companies will have to deal with an even more complex tax situation due to remote work.

For example, employees working remotely in a different state than the business’s location can create a tax nexus, requiring the company to withhold state income taxes for those states. Learn more about the new tax implications of remote work here. Many jurisdictions now require withholding taxes based on the employee’s physical work location. This means employers must carefully track employee locations and follow each location’s tax laws. This can be very complicated for businesses with employees spread across many states.

Understanding Tax Nexus

Understanding tax nexus is essential for employers with remote workers. A nexus happens when a company has enough presence in a state to trigger tax obligations. This presence can be physical, like an office, or economic, which is common with remote workers. Even one remote employee can create a nexus, leading to new tax responsibilities in that state. These responsibilities might include registering with state tax authorities, filing tax returns, and withholding income tax.

Multi-State Payroll Management

Managing payroll across multiple states adds another layer of complexity. Each state has its own tax laws, rates, and filing requirements. This can be difficult for businesses not used to multi-state payroll. Employers need to ensure they withhold the right amount of taxes based on each employee’s work location and file the necessary returns with the right agencies. Often, this requires specific payroll software or help from a payroll provider experienced in multi-state compliance.

International Remote Team Taxation

For companies with international remote teams, taxes become even more complicated. International tax laws differ significantly from country to country, and navigating these laws can be a major challenge. Employers must understand tax treaties, residency rules, and other international tax factors to stay compliant. Currency conversions and international payroll processing also add complexity. These challenges usually mean working with international tax advisors or specialized global payroll providers. Not complying with international tax regulations can lead to serious penalties and legal issues.

Unlocking Home Office Deductions That Actually Matter

Beyond simply calculating the square footage of your home office, a whole range of tax deductions exists specifically for remote workers. Many are unaware of these potential savings and miss out on substantial tax breaks. We’ll explore these impactful deductions, drawing on insights from tax professionals specializing in remote work.

Defining Your Home Office

First, it’s crucial to understand the IRS definition of a legitimate home office. It’s not just any spot where you occasionally answer emails. The exclusive use rule stipulates that the area must be used only for business, regularly and exclusively, as your principal place of business. A dedicated room with a door used solely for work qualifies. A dining table used for both meals and work does not. For more tips on optimizing your work-from-home setup, check out this helpful resource: How to master remote work best practices.

Deductible Expenses: Partial vs. Full

Once you have a qualifying home office, certain expenses become deductible. Direct expenses, like painting or repairs to your dedicated workspace, are fully deductible. Indirect expenses, such as mortgage interest, property taxes, utilities, and rent, are partially deductible. The deductible portion is based on the percentage of your home used for your office.

Documenting Your Deductions: Avoiding Red Flags

Meticulous record-keeping is crucial to a smooth IRS audit. Keep detailed records of all home office expenses, including receipts, invoices, and logs. Think internet bills, utility statements, and insurance premiums. Avoid common pitfalls like sloppy record-keeping or exaggerating expenses, as these can raise red flags. A handy tool for calculating potential savings is the Home Office Deduction Calculator.

Simplified vs. Regular Method: Which Saves You More?

Two methods exist for calculating the home office deduction: the simplified method and the regular method. The simplified method uses a standard deduction per square foot up to a maximum amount. The regular method requires more detailed calculations based on actual expenses and the percentage of your home dedicated to business use. While the simplified method seems easier, the regular method often yields greater deductions, especially with significant home office expenses. Consult a tax professional or use a calculator to determine the best method for your specific situation.

Overlooked Deductions: Maximizing Your Savings

Many remote workers overlook valuable deductions. Internet service, vital for most remote setups, is partially deductible. A portion of your utility bills (electricity, heating/cooling) attributed to your home office can also be deducted. Homeowners insurance and even some home maintenance costs allocated to your workspace can contribute to reducing your taxable income. By carefully tracking and documenting these often-missed deductions, you can legally minimize your remote work taxes and keep more of your earnings.

Multi-State Taxation: Avoiding the Double-Tax Trap

Working across state lines presents unique tax challenges for remote workers. Many find themselves navigating a complex web of regulations, sometimes facing the possibility of double taxation. This section offers guidance through the multi-state tax maze, clarifying key concepts to help you stay compliant.

Understanding State Tax Residency

The first step is determining your state tax residency. Typically, the state where you live and work is the one that levies income tax. However, each state has its own rules. Some states determine residency based on where you spend the majority of the year. Others consider factors like your driver’s license, voter registration, and property ownership. This can mean that even brief remote work stints in another state might trigger tax residency there.

Reciprocity Agreements: A Taxpayer’s Friend

Thankfully, reciprocity agreements exist between some states. These agreements prevent double taxation. They allow residents of one state to work in another without being taxed by the second state. For example, a Virginia resident working in the District of Columbia benefits from a reciprocity agreement, paying taxes only to Virginia. It’s essential to confirm the specifics of these agreements, as they don’t cover all states or all situations.

Convenience of Employer Rules: The New York Case

Some states, like New York, have “convenience of employer” rules. These rules can mean that if you work for a New York-based company but live elsewhere, you still owe New York taxes, even if you never physically work in the state. New York views the remote arrangement as a convenience offered by your employer, making it taxable by New York. This can lead to double taxation if your home state doesn’t offer a credit for taxes paid to another state.

Tracking Work Location and Documenting Residency

Meticulous record-keeping is crucial. Track where you work each day of the year. A simple spreadsheet or dedicated tracking apps can suffice. This documentation helps determine which state has the right to tax your income. Maintain proof of your primary residence, such as utility bills, bank statements, and lease agreements. This is especially important in case of an audit.

Minimizing Your Multi-State Tax Burden

Several strategies can help minimize your multi-state tax liability. Understanding your state’s tax laws and any applicable reciprocity agreements is key. If you’re working in multiple states, consult with a tax advisor. They can help optimize your tax strategy and ensure compliance. Accurate records of your work location and expenses can also help you claim any applicable deductions and credits.

Court Cases and Legal Precedents

Recent court cases continue to shape remote work taxation, often challenging “convenience of employer” rules, especially regarding double taxation. Staying informed about these developments is important. These legal battles highlight the dynamic nature of remote work taxes and the value of expert advice. Proactive steps help remote workers navigate the tax system and maintain their financial well-being. For additional best practices on remote work, check out our article on Remote Work Security Best Practices.

Crossing Borders: International Remote Work Tax Strategies

The digital nomad lifestyle offers incredible freedom, but managing taxes across international borders can be complex. Understanding your tax obligations as a location-independent professional is crucial to avoid penalties and maximize your earnings. This means navigating tax residency rules, international tax treaties, and individual country regulations.

Determining Tax Residency: Where Do You Really Live?

One of the first steps in international remote work tax planning is determining your tax residency. This isn’t simply where you’re currently living, but where you’re considered a resident for tax purposes. Different countries have different rules, often based on physical presence (how many days you spend in a country) and other ties like property ownership or family connections.

Some countries consider you a tax resident if you stay for 183 days or more in a year, while others have more complex rules involving a “center of vital interests.” Misunderstanding these rules can lead to double taxation, meaning you owe taxes to two different countries on the same income.

Tax Treaties: Your Shield Against Double Taxation

Tax treaties are agreements between countries designed to avoid double taxation and prevent tax evasion. These treaties are invaluable for digital nomads. They often specify which country has the right to tax certain types of income and can reduce or eliminate withholding taxes on income earned abroad.

For example, a treaty might allow a US citizen working remotely in Portugal to pay taxes only to the US on certain income. Researching tax treaties between your country of citizenship and the countries where you work is essential.

The Foreign Earned Income Exclusion: A Major Tax Break for US Citizens

US citizens and green card holders working abroad may qualify for the Foreign Earned Income Exclusion. This allows you to exclude a significant portion of your foreign earned income from US taxation. For the 2023 tax year, the exclusion was $120,000.

This means if you earned up to this amount while working abroad and met the requirements, you wouldn’t owe US income tax on it. Understanding the specific qualifications for the exclusion is crucial, as it isn’t automatic. Learn more in our article about managing remote teams.

Navigating Country-Specific Tax Incentives and Visas

Many countries actively attract remote workers by offering special visa programs and tax incentives. Some countries offer digital nomad visas with simplified application processes and tax benefits. Others provide temporary residency permits with attractive tax rates for foreign income.

Researching these programs is crucial, as they can significantly reduce your tax burden and provide a legal framework for your international lifestyle.

Foreign Bank Account Reporting: Staying Compliant Across Borders

If you maintain foreign bank accounts, you might be subject to Foreign Bank Account Reporting (FBAR) requirements. These regulations require US citizens and residents to report foreign accounts holding over a certain amount. Failing to comply can result in hefty penalties.

Additionally, stay aware of evolving regulations related to cryptocurrency and digital assets held in foreign accounts, as tax laws are adapting to these new forms of investment.

The Global Minimum Tax: A Game-Changer for Digital Nomads

International tax laws are constantly evolving. The global minimum tax, set to take effect in 2025, will impact remote work tax compliance. This initiative aims to establish a standardized minimum tax rate globally, reducing tax base erosion and profit shifting.

This affects digital nomads who often work from various locations. Explore this topic further here. Understanding these changes is critical for maintaining a tax-efficient international remote work structure. You might also be interested in: How to master managing remote teams.

Building a Tax-Efficient International Lifestyle

With proper planning and expert advice, you can legally optimize your global tax situation while enjoying the freedom of remote work. This includes:

Consulting with a tax advisor specializing in international taxation. They can help you navigate complex regulations and identify tax savings.

Keeping meticulous records of your income, expenses, and travel. This documentation is crucial for demonstrating compliance with tax laws.

Staying updated on changes in tax regulations. International tax laws change frequently, so staying informed is essential.

By understanding international remote work taxes and taking proactive steps, you can minimize your tax burden, avoid penalties, and enjoy the financial benefits of your location-independent lifestyle.

Building an Audit-Proof Remote Work Tax System

A well-organized tax system is essential for stress-free remote work. This means establishing a reliable system for documenting your work activities and expenses to support your tax claims. This section offers practical advice and examples to help you build a robust record-keeping system that will protect you during a tax audit.

Essential Documents for Remote Workers

Knowing which documents to retain, and for how long, is the first step towards a secure tax system. Here’s a breakdown of the key documents you’ll need:

Income Records: These include pay stubs, 1099 forms, and bank statements that verify your earned income.

Expense Records: Keep receipts, invoices, and credit card statements for all work-related expenses. This is particularly crucial for home office deductions.

Home Office Documentation: Maintain records of your home office’s size and how it’s used, including photographs or floor plans. Accurate measurements are important.

Location Records: Keep proof of where you worked throughout the year. This is especially important for those working across multiple states. Consider a spreadsheet or app for easy tracking.

Retention Periods: How Long to Keep Records

The IRS generally recommends keeping tax records for three years. However, some circumstances require longer retention. If you claim a home office deduction, keep records for the duration of the deduction. This ensures you have the necessary documentation should an audit occur. If you significantly underreport your income, the IRS can audit up to six years back. Therefore, keeping records for six years offers maximum protection.

Digital Tools for Streamlined Organization

Managing tax documents doesn’t have to be a headache. Digital tools can significantly simplify the process. Cloud-based accounting software like QuickBooks or Xero is excellent for tracking expenses and generating reports. Dedicated expense tracking apps can also be helpful. Scanning and digitally storing receipts reduces clutter and provides easy access during tax season.

Tracking Variable Expenses and Documenting Home Office Usage

A common challenge for remote workers is tracking variable expenses like utilities and internet. One straightforward method is allocating a percentage of these expenses based on your home office’s size relative to your total home size. If your home office occupies 15% of your home’s square footage, you might deduct 15% of eligible utility costs. Always document your calculation method.

Documenting home office usage is crucial. Photographs of your workspace demonstrate its exclusive use for business. A log of daily work activities further supports your claim.

Maintaining Audit-Proof Location Records

For multi-state workers, accurate location records are particularly important. A simple spreadsheet or dedicated app can track where you work each day. This provides a clear record if questions arise regarding tax residency or where your income was earned.

Templates and Resources for Effective Documentation

Creating templates for common documentation tasks saves time and ensures consistency. An expense log template should detail the date, vendor, amount, and purpose of each expense. A home office measurement template helps ensure accurate calculations for deductions. A vehicle usage log, especially if you use your car for work, helps track mileage and associated expenses.

Building Confidence in Your Tax Deductions

By following these record-keeping practices, you can build confidence in your remote work tax deductions. A well-organized system reduces stress during tax time and protects you in case of an audit. Combined with an understanding of security risks related to remote work, this organized approach creates a more secure and productive experience. For further guidance on remote work security, check out our article on Remote Work Security Best Practices. Proper documentation is the key to claiming legitimate deductions and enjoying the financial benefits of remote work.

Future-Proofing Your Remote Work Tax Strategy

Strategic tax planning for remote workers isn’t just about meeting the annual tax deadline; it’s about optimizing your financial situation throughout the entire year. This involves understanding how the choices you make today will affect your tax liability in the future.

Timing Income Recognition and Leveraging Retirement Accounts

Successful remote workers often time their income recognition. This means strategically choosing when to invoice clients or receive payments, especially if they have some control over their payment schedule. This can be particularly helpful for freelancers or independent contractors.

Additionally, maximizing contributions to retirement accounts designed for independent professionals, such as SEP IRAs or Solo 401(k)s, can significantly reduce your current taxable income while building a secure financial future. These accounts offer higher contribution limits than traditional IRAs, allowing for greater tax savings and faster retirement savings growth.

Structuring Work Arrangements to Maximize After-Tax Income

The way you structure your work arrangements can significantly impact your taxes. For example, if you’re working across state lines, understanding reciprocity agreements or exploring residency in a state with a lower tax burden can affect how much you owe. It’s important to remember that changing residency has legal implications, so thorough research and proper documentation are essential.

If you frequently work with international clients, structuring your work through a business entity, such as an LLC or S-corp, might offer tax advantages. However, the benefits depend on your individual circumstances.

Entity Formation: When Does it Make Sense?

Forming a business entity, like an LLC or S-corp, can be complex, but it can also unlock tax benefits for some remote workers. This might involve deducting business expenses or potentially having some income taxed at lower corporate rates.

However, entity formation isn’t a universal solution. It comes with additional administrative burdens and costs. Consulting with a tax professional is essential to determine if forming an entity aligns with your long-term financial goals and your specific remote work situation.

Coordinating Tax Planning with Your Spouse or Partner

If you’re married or in a domestic partnership, coordinating tax planning with your partner is crucial. This might involve filing jointly or separately, depending on your combined income and deductions.

For instance, if one partner has high medical expenses, filing jointly could allow you to deduct a greater portion of those expenses. Understanding how various tax laws interact with your filing status is essential for minimizing your combined tax liability.

Staying Ahead of Emerging Tax Law Changes

Tax laws, especially those related to remote work, are constantly changing. Staying informed about potential changes is crucial for future-proofing your tax strategy. Subscribing to reputable tax publications or consulting with a tax professional can help you stay up-to-date and adapt your strategies.

This proactive approach enables you to take advantage of new tax benefits or mitigate potential liabilities. For example, changes to home office deduction rules or updates to international tax treaties could significantly impact your tax obligations.

Ready to take control of your remote work career and discover exciting new opportunities? Explore a world of possibilities at Remote First Jobs, where you can find your ideal remote position and connect with companies that value flexibility and innovation.